Master the Chase Trifecta: Turn Everyday Spending Into First-Class Travel

If you’re still earning 1% cash back on everything, it's time for a glow-up. The Chase Trifecta is not just a cute nickname — it’s a strategy. With the right combination of Chase cards, your morning coffee, Tuesday gas fill-up, and that “oops I forgot we needed printer ink” moment could be quietly working toward your next flight to Greece. Or Tokyo. Or honestly, Cleveland if that's your thing.

Let’s break down this points powerhouse — without boring you to death. Promise.

💡 What Is the Chase Trifecta?

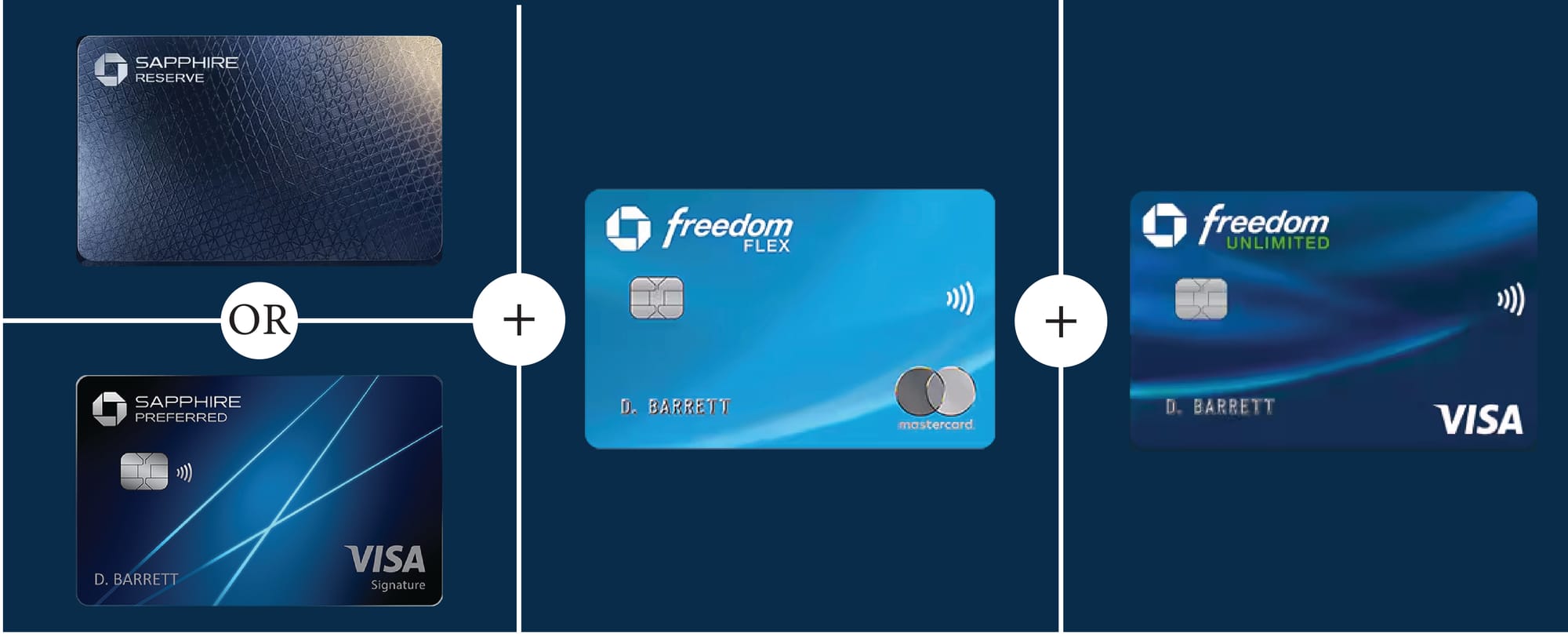

Think of it like the Avengers of travel rewards: each card is strong alone, but together, they’re nearly unstoppable. The Chase Trifecta is a combo of three Chase Ultimate Rewards cards:

- One Sapphire card (for travel & redemption boosts)

- Freedom Unlimited® (for consistent earning)

- Freedom Flex® (for rotating bonus categories)

The magic? You can combine all the points you earn into your Sapphire account, where they’re worth more for travel or transferable to airline and hotel partners. That’s how savvy travelers fly business for economy prices.

🔑 Meet the Chase Trifecta Crew

Here’s your elite squad of earners and how they work together.

| Feature | Chase Sapphire Reserve® | Chase Sapphire Preferred® | Chase Freedom Unlimited® | Chase Freedom Flex® |

|---|---|---|---|---|

| Annual Fee | $795 | $95 | $0 | $0 |

| Travel Portal Value | Up to 2 cents/point | Up to 1.75 cents/point | 1 cent (can be boosted) | 1 cent (can be boosted) |

| Main Earning | 8x Chase Travel, 4x direct travel, 3x dining | 5x Chase Travel, 3x dining/grocery/streaming | 1.5% on all, 5% Chase Travel, 3% dining | 5% rotating, 5% Chase Travel, 3% dining |

| Top Perks | Lounge access, $300 travel credit, TSA PreCheck credit, luxury hotel credits | $50 hotel credit, 10% anniversary bonus | High base rate, no fee | 5% bonus categories |

✈️ Sapphire: Your Travel Powerhouse

This is your redemption engine. Your transfer portal. Your ticket to turning 50,000 points into something that actually feels like a reward.

🛫 Chase Sapphire Reserve®

For those who travel often and want every perk under the sun.

- $795 annual fee, but loaded with credits

- 8x on Chase Travel bookings, 4x on direct flights/hotels

- 3x on dining worldwide

- Lounge access via Priority Pass Select

- $300 annual travel credit

- Points worth up to 2 cents each in Chase Travel℠

🧳 Chase Sapphire Preferred®

Same travel focus, way smaller price tag.

- $95 annual fee

- 5x on Chase Travel bookings

- 3x on dining, online groceries, streaming

- 10% anniversary point bonus

- Points worth up to 1.75 cents each in Chase Travel℠

Not sure which to choose? Check out our Sapphire comparison HERE.

🛍 Freedom Unlimited®: The Default Dynamo

This card is your reliable workhorse. You pull it out when nothing else fits and it still rewards you.

- 1.5% back (aka 1.5 points) on everything

- 5% back on Chase Travel bookings

- 3% back on dining and drugstores

- No annual fee, no drama

🌟 Benefits of Chase Freedom Unlimited®

- Intro APR offer: 0% intro APR on purchases and balance transfers for 15 months, then a variable APR applies

- Purchase protection: Covers new purchases against damage or theft for up to 120 days (up to $500 per claim, $50,000 per account)

- Extended warranty: Adds 1 extra year on eligible U.S. manufacturer’s warranties

- Trip cancellation/interruption insurance: Up to $1,500 per person and $6,000 per trip for pre-paid, non-refundable expenses

- Three-month DoorDash DashPass membership (activation required), then 50% off for the next 9 months

- No minimum to redeem points — whether it's 10 bucks or 10,000 points, you're good to go

Perfect for people who want low-maintenance, high-impact rewards. It just works.

🔁 Freedom Flex®: Your Strategic Secret Weapon

This card is all about timing. It features quarterly 5% bonus categories, which can be anything from gas stations to Amazon to streaming services.

- 5% back on quarterly categories (up to $1,500 spend)

- 5% back on Chase Travel

- 3% back on dining and drugstores

- No annual fee

⚠️ Reminder: You need to activate each quarter’s categories manually (takes about 10 seconds).

🎁 Benefits of Chase Freedom Flex®

- Intro APR offer: 0% intro APR on purchases and balance transfers for 15 months, then a variable APR applies

- Purchase protection: Same coverage as the Unlimited — damage or theft protection for 120 days

- Cell phone protection: Up to $800 per claim (with $50 deductible) when you pay your cell phone bill with the card

- Extended warranty and trip cancellation/interruption insurance

- World Elite Mastercard® benefits, including Lyft credits, ShopRunner membership, and discounts on Boxed, Fandango, and more

- DoorDash DashPass deal: Just like the Unlimited — free for 3 months, half-off for 9 more

This card punches way above its weight class for something with a $0 annual fee.

🧠 How They Work Together: Max Out Every Swipe

You don’t need a spreadsheet (unless that sparks joy). Just follow this simple strategy:

| Purchase Type | Use This Card |

|---|---|

| Chase Travel bookings | Sapphire (Reserve or Preferred) |

| Dining | Sapphire or Freedom Unlimited (tie) |

| Drugstores | Freedom Unlimited or Flex |

| Quarterly categories | Freedom Flex |

| Everything else | Freedom Unlimited |

Then, move all your points into your Sapphire account. Boom — you’ve got flexible, turbo-charged points that are worth way more when used smartly.

🚀 Best Redemption Strategies

Okay, so you’ve got points. Now what?

1. Chase Travel Portal

Book flights, hotels, cars, and more directly. Your Sapphire boosts the value:

- Sapphire Reserve: Up to 2 cents per point

- Sapphire Preferred: Up to 1.75 cents per point

It’s simple and straightforward, especially if you’re not ready to deep-dive into partner programs.

2. Transfer to Travel Partners

Want to squeeze out ridiculous value? Send your points to one of Chase’s 1 to 1 transfer partners, like:

✈️ Airlines: United, Southwest, JetBlue, Emirates, British Airways, Air France, and more

🏨 Hotels: Hyatt, Marriott, IHG

Hyatt is the golden goose here. Redemptions can reach 3 cents per point or higher. That $100 grocery haul just got you a free night.

🧐 Is the Trifecta Right for You?

Let’s get real, this strategy isn’t for everyone. Here’s a quick gut check:

✅ Great fit if:

- You travel at least once or twice a year

- You don’t mind tracking a few bonus categories

- You pay your balance in full every month (no exceptions)

🚫 Not ideal if:

- You’re looking for pure cash back

- You don’t want to juggle multiple cards

- You’re over the Chase 5/24 rule (opened 5+ cards in last 24 months)

Final Thoughts: Points, But Make It Powerful

The Chase Trifecta isn’t about chasing status or flexing plastic. It’s about being strategic. It’s a smart way to turn boring bills into bucket list adventures without overcomplicating your life.

Use the cards where they shine. Pool your points. Redeem with a little know-how. And suddenly, you're flying to Italy in lie-flat seats that didn’t cost you a dime (except maybe for extra gelato).

✏️ The Quick and Dirty Summary

- Chase Trifecta = Sapphire + Freedom Unlimited + Freedom Flex

- Use each card where it earns the most

- Pool your points into Sapphire for higher redemption value

- Best for travel rewards, not ideal for cash back lovers

- Keep tabs on bonus categories and the 5/24 rule

Suggested CTA:

🎯 Ready to level up your points strategy? Start with the Sapphire Preferred or Reserve, then stack your way to smarter spending.

Previous Post You May Have Missed

Notes: Some links in this post may earn us a small commission at no extra cost to you, as we participate in affiliate programs. This is how we can continue to work and bring you the latest and best content.

All information is accurate as of the date of publication but may change over time.

Always check for the latest details before making travel plans.