The New Chase Sapphire Reserve and Sapphire Reserve for Business: Big Fees, Bigger Perks

Chase just dropped the most dramatic Sapphire refresh we’ve seen in years. Starting June 23, 2025, the Sapphire Reserve gets a $245 price bump and a glow-up filled with travel credits, luxury perks, and enough fine print to give your eyeballs whiplash.

If you’re wondering whether the new $795 annual fee is worth it—or if Chase just made your wallet heavier in guilt instead of metal—keep reading.

Whether you’re a traveler, a business owner, or both, here’s everything you need to know about Chase’s most premium cards—including how to actually squeeze value out of them before your benefits expire and vanish like forgotten DoorDash credits.

Ready, Set, Hyperfocus!

💳 What Both Cards Have in Common

Let’s start with what these two cards share because spoiler: the bones are the same.

- $795 annual fee

- Access to Chase Sapphire Lounges and Priority Pass Select (with 2 guests)

- $300 annual travel credit (ultra-flexible: applies to nearly anything travel-related)

- Access to The Edit by Chase Travel hotel program

- Packed with lifestyle, dining, travel, and tech credits

- Tons of ways to earn points quickly, with travel booked through Chase earning the biggest bonuses

- No foreign transaction fees

- All credits and promos must be used in the designated time window—they do not roll over

Now let’s break them down individually—because while they’re siblings, they’ve got different strengths.

🧍♀️ Chase Sapphire Reserve for Personal

This card was always for travelers. Now it’s for very organized travelers. Here’s what’s new and how it works:

🔥 What's New for 2025:

- Annual fee increased to $795

- New metal card design (you'll get it when your current card expires)

- Points Boost replaces the old flat 1.5x travel redemption rate, now you can earn up to 2X point value (1.25X to 2X on specific bookings through Chase Travel on flights, hotels, packages). Fine print still developing, but it sounds like more hoops = more value.

- Huge lineup of new perks but none of the credits roll over. Use it or lose it.

💸 Credits & Benefits Breakdown

Here’s the meat of the card—what you’re actually getting for $795 a year:

✈️ $300 Travel Credit

- Covers almost any travel expense (airfare, hotels, rental cars, tolls, parking, etc.)

- Automatically applied—zero hoops

🛏️ $500 The Edit Hotel Credit

- $250 every six months

- Book through Chase’s new luxury hotel collection (The Edit)

- Included perks with booking: breakfast, $100 property credit, room upgrades, and late checkout

🍽️ $300 Dining Credit via Exclusive Tables

- $150 every six months

- Can only be used when you book through Exclusive Tables, Chase’s premium OpenTable-powered reservation platform.

👉 Link your card and reserve

🎟️ $300 StubHub/Viagogo Credit

- $150 every six months

- Use it on concerts, sports, theater tickets—anything live and overpriced

🛵 $300 DoorDash Credits + DashPass

- $5 monthly restaurant promo

- Two $10 monthly promos for groceries, beauty, electronics, etc.

- Free DashPass membership (valued at $120/year)

🍎 Apple subscriptions

- Complimentary subscriptions to Apple TV+ and Apple Music (valued at $250/year)

🚴♀️ $120 Peloton Credit

- Plus 10X points on Peloton purchases. Credit applies for membership and purchases.

🧳 Reserve Travel Designers

- Complimentary trip planning

- Up to $300 in added value per trip

🧳 Travel Perks & Protections Stay Strong

Despite the overhaul, the premium travel protections remain intact:

- Priority Pass Select lounge access (for you and 2 guests)

- Chase Sapphire Lounge by The Club access

- Trip cancellation & interruption insurance

- Primary rental car insurance

- Lost luggage reimbursement

- Travel delay reimbursement

- No foreign transaction fees

🧠 Still one of the best cards out there for travel protections, period.

💼 Bonus Perks for Big Spenders ($75K/year)

Hit $75,000 in calendar-year spend and you unlock:

- IHG Diamond Elite status

- Southwest A-List status

- $500 Southwest Airlines travel credit

- $250 in statement credits at The Shops at Chase (featuring Dyson, Sony, Therabody, TUMI, and more)

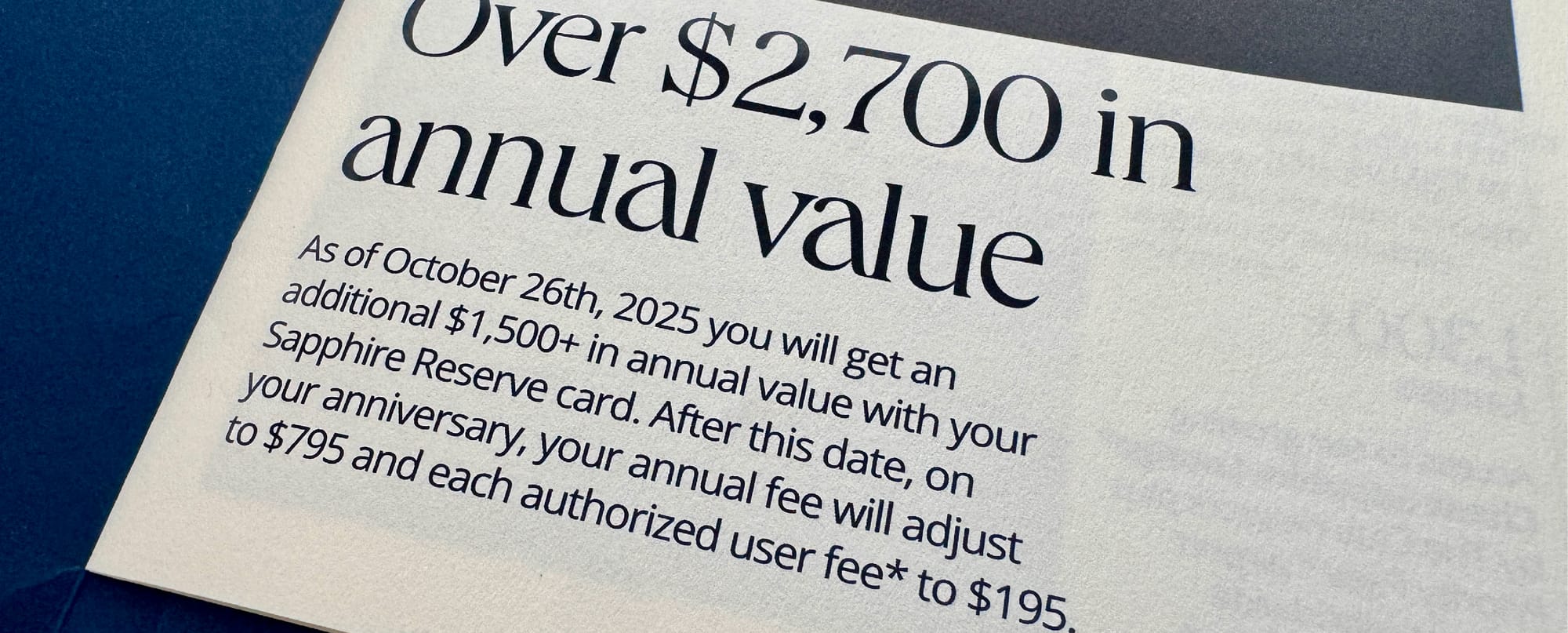

⏰ Timeline for Current Cardholders

If you already have the personal Sapphire Reserve:

- June 23, 2025: You can start benefiting from Points Boost

- October 26, 2025: All new credits and perks become available

- Your renewal date after Oct. 26: Your annual fee increases to $795

You’ll receive the new card design at your card's next expiration date—not immediately.

👔 Chase Sapphire Reserve for Business

This one’s built for entrepreneurs, agencies, consultants, and anyone who racks up serious expenses while growing their empire. It mirrors the personal card, but adds tools for business spend and management.

📈 Points Earnings:

- 8X points on travel through Chase Travel

- 5X points on Lyft (through Sept. 30, 2027)

- 4X points on flights and hotels booked directly

- 3X points on social media and search engine ad spend (no cap!)

- 1X on everything else

🧠 That 3X uncapped ad category is rare—huge win for anyone running paid campaigns.

🧾 Credits and Benefits

All the great travel and lifestyle benefits of the personal card—plus business-focused perks:

🛠️ $400 ZipRecruiter Credit

- $200 every six months

- For job listings, candidate screening, and hiring tools

🧠 $200 Google Workspace Credit

- Use toward AI tools, Gmail, Drive, Meet, and more

🎁 $100 Giftcards.com Credit

- $50 every six months

- Handy for client gifts, employee gifts, or incentives

🔁 Reminder: NONE of these credits roll over. Use them in the window, or lose them forever.

💎 Premium Travel Perks

- Chase Sapphire Lounges + Priority Pass Select (2 guests allowed)

- Complimentary IHG Platinum Elite Status

- All the same trip protections and insurance as the personal Reserve card

🏆 Premium Benefits Unlocked at $120K/year

Spend six figures in a calendar year and unlock:

- IHG Diamond Elite Status

- Southwest A-List Status + $500 travel credit

- $500 credit at The Shops at Chase

🧠 These are huge adds if you're booking travel or buying premium goods with points or charging ad spend like it’s your job (because it is).

💳 Business Payment Flexibility

- Pay-in-full high-limit card

- Access to Flex for Business, which lets you carry a balance (with interest) if needed

🧠 Great for smoothing out cash flow or floating big purchases.

🤔 So… Is the Sapphire Reserve (Personal or Business) Worth $795?

Let’s cut through the noise. The smartest way to figure out if either Sapphire Reserve card is a good fit? Run the math:

Step 1: Add up the credits and perks you would actually use.

Not in theory. In real life. Be honest.

| Benefit | Value | Will You Use It? |

|---|---|---|

| $300 Travel Credit | $300 | ✅ Likely yes |

| $500 The Edit Credit | $500 | ✅ If you stay at premium hotels |

| $300 StubHub Credit | $300 | 🎟️ Maybe for a concert or game? |

| $300 Dining Credit (Exclusive Tables) | $300 | 🍽️ If you eat fancy or live near participating cities |

| $300 DoorDash Promos + DashPass | $300 | 🛵 If you order at least once a month |

| $250 Apple One Credit | $250 | 🍎 If you subscribe (or gift it to Dad) |

| $120 Peloton Credit | $120 | 🚴 If you use the gear or app |

| $300 Travel Designer Value | $300 | 🧳 If you like someone else planning your trip |

| Business Extras (ZipRecruiter, Google Workspace, Giftcards.com) | Up to $700 | 👔 If you’re running a business |

Now total it up and subtract it from the $795 annual fee.

Does your realistic value exceed the fee?

✅ Yes? It could be the right card for you.

❌ No? Then maybe pass for now. Or re-evaluate in the future.

💡 Not Spending There Yet? Think Bigger.

Maybe you don’t use DoorDash or Apple One now. But you’ve been meaning to. Or…

- You want to gift Apple TV+ to your dad

- Let your pregnant sister use your DoorDash credits (because cravings are real)

- Surprise your partner with concert tickets from StubHub

Even if you’re not the one using every benefit, someone close to you probably will. And yes, you can absolutely add the card to a trusted person’s account (like for Apple or DoorDash) to trigger the monthly credits. Just make sure you’re not using the annual subscription option, that won’t activate the monthly promos.

📅 Timing Tips: When to Apply (and When to Wait)

- Apply here before June 23 to lock in the current $550 fee for one more year and score 60,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening

- Existing cardholders don’t get the new fee or perks until your renewal date after October 26, 2025

- Rumor has it Chase will remove the 48-month rule, meaning you may soon be able to get bonuses for both the Preferred and Reserve without playing the waiting game

Final Thought

You're not buying a card. You're buying access to a curated set of luxury perks, elite rewards, and convenience credits. If you’ll use them—even creatively—it’s a strong value. If not? Let someone else burn the $795 while you collect points elsewhere.

Either way, at least now you know exactly how to calculate what the Sapphire Reserve is really worth to you.

Just don’t let the credits sit around unused—none of them roll over, and if you don’t use them in the specified window, they’re gone for good. Calendar reminders and auto payments come in clutch here.

Ready to make your spending smarter? Pick the card that matches your lifestyle, and let it work as hard as you do.

Previous Post You May Have Missed

Notes: Some links in this post may earn us a small commission at no extra cost to you, as we participate in affiliate programs. This is how we can continue to work and bring you the latest and best content.

All information is accurate as of the date of publication but may change over time.

Always check for the latest details before making travel plans.